Guardianship law in New York is based on two types of guardianships, limited and plenary. Limited guardianship gives a guardian certain rights and responsibilities for the person who cannot take care of themselves. The guardian has to be appointed by a court and can be given control over property and finances. The court determines the limitations of guardianship so that it does not interfere with the person’s autonomy or rights.

Plenary guardianship means that the guardian’s authority is unlimited on all matters relating to you–including your health care, finances, where you go, who you see. etc

The court will appoint at least one person as your guardian if there are no living parents or other suitable relatives available to act as your guardian or if their condition makes them incapable of acting as your guardian.

When seeking to obtain guardianship over an individual incapable of making their own decisions, you might want to look into Article 81 or 17-A of the Mental Hygiene Law in New York. Guardianship is often sought when a person with dementia or Alzheimer’s becomes incapacitated and incapable of living independently. If this individual was intellectually or developmentally disabled, they would be more likely to need an Article 17-A guardianship. Article 17-A guardianships are most often used when developmentally disabled people reach the age of 18 and their parents or guardian need to apply for power of attorney so you can make decisions on their behalf. Guardianships in Article 17-A are brought in Surrogates Court, while guardianship proceedings in Article 81 are held at Supreme Court.

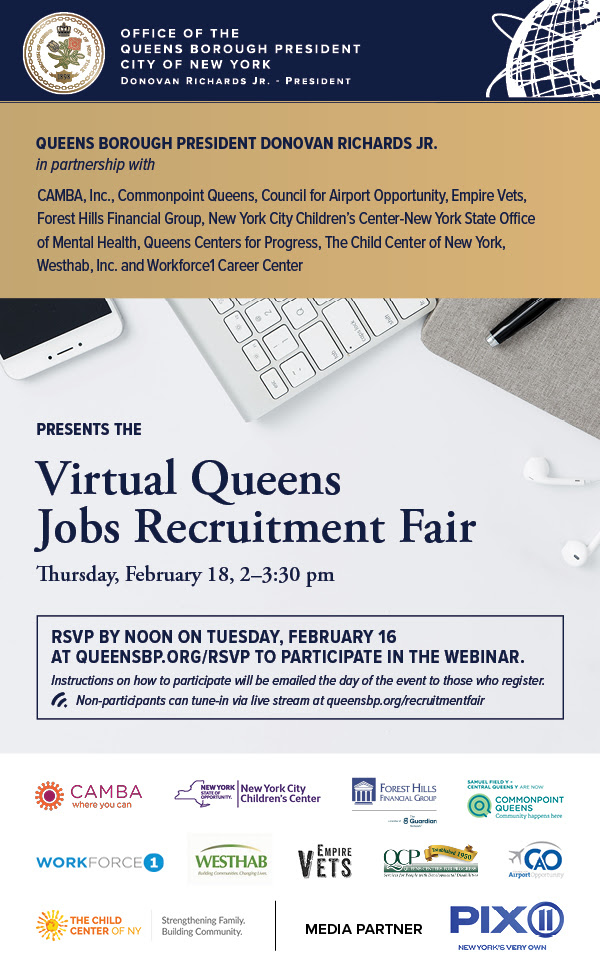

For more information about Guardianship law in New York State please contact Law Offices Of Roman Aminov.

Law Offices Of Roman Aminov, 147-17 Union Turnpike, Flushing, NY 11367 – (347) 766-2685

You must be logged in to post a comment.